Germany has a track record of economic growth and success over the past decade. Therefore, more and more companies start to recognize the great potential that lies in this market. But if taxes are too high, businesses are still struggling to enter a market. The question remains, how do Germany’s taxes compare to other markets in the world?

Attractive Market – An attractive tax system?

Private Equity funds start to increasingly invest in German companies known for their world-class expertise in various industries. And since Germany is still the largest economy in the EU with the 4th largest GDP in the world, it remains an attractive consumer market for the next years to come.

Taxes in Germany from a global perspective

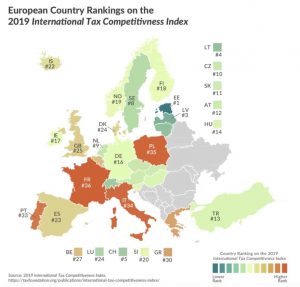

The Tax Foundation is an independent American nonprofit think-tank, which aims to educate taxpayers internationally. It regularly releases an International Tax Competitiveness Index, in order to compare the tax rates of different countries in the light of competitiveness which highlights the most competitive tax rates in different countries around the world.

How do taxes affect your business?

Taxes have an undeniable impact on every business. For instance, a well designed corporate tax rate can promote economic development. Consequently, this can boost revenue for the company and the country it pays taxes in.

Ultimately, for a company, it plays a vital role in calculating the overall economic performance. The study measures two core aspects of tax policy, competitiveness, and neutrality, across over forty variables regarding tax policy.

Taxes can make or break an investment decision

Businesses will commonly try to invest their funds into countries and regions where they can earn the highest rate of return on their investment. For the index, this means, that the most successful nations are those with the lowest corporate tax rates. Additionally, the processes for companies to comply with local tax laws should be as easy as possible.

Overall, Estonia has the highest score in the index. And they have had the top position for the last six years! Arguably, the 20 percent tax on corporate profit applied to distributed profits contributes to this rating.

Furthermore, the individual income tax is 20 percent and does not apply to personal dividend income. Property tax in Estonia only applies to the value of the land.

Last but not least, 100 percent of foreign profits earned by domestic corporations are exempt from domestic taxation.

In terms of taxes, Estonia profits from transparency, low rates overall and easy processes. Consequently, it gets the highest score of 100. But how is Germany doing in terms of its taxes?

Tax Competitiveness Index 2019 | © taxfoundation.org

Taxes in Germany: Strengths and Weaknesses

By comparison, Germany ranks at number 16 worldwide and has mixed results. The overall score is only 66.94, so roughly two-thirds of the winner Estonia. This gives Germany a lead over countries like the USA, Spain, the UK, and many other EU member states. The three strong points for in the German tax system are:

Strong points of the German tax system

- Inventory can receive Last-In-First-Out treatment, the most neutral treatment of inventory costs.

- Germany has a broad tax treaty network, with 96 countries.

- The VAT tax rate of 19 percent is near the OECD average (19.1 percent) and the VAT compliance burden is relatively low.

Weak spots for taxes in Germany

This is all beneficial for businesses but there were some factors dragging down the performance of Germany from a tax perspective for businesses. These include:

- Germany has the fifth-highest corporate income tax rate among OECD countries, at 29.9 percent.

- The personal income tax is complex. With an associated compliance burden of 134 hours-the third-highest among OECD countries.

- There are limits for companies in the amount of net operating losses they can use to offset income on future or previous tax returns.

Top 5 countries for tax competitiveness

Especially the complexity of compliance in personal income tax in Germany is a problem. This part ranks among the worst in the OECD and far behind the Top 5.

After Estonia, New Zealand occupies the 2nd place for its competitive tax system. It features e.g. no taxation of capital gains. Closely following were Latvia and Lithuania.

This highlights the strong will of reform in the Baltics after the collapse of the Soviet Union. Switzerland came in 5th largely due to its property taxes. They come with separate levies on real estate, net wealth, estates, assets, and financial transactions.

How taxes can make a country less competitive?

In contrast, France ranked as the least competitive country in the index. This correlates to its high corporate income tax rate of 34.4 percent.

Secondly, the burden increases with high property taxes, a net tax on real estate wealth, a financial transaction tax and an estate tax. The United States improved its score this year due to President Trump’s 2017 tax overhaul. But it was still only in the 21st position with a score of 63.7 for its tax system.

Conclusion – Taxes in Germany

In summary, Germany offers a rather competitive system of taxes for companies. The average tax burden on companies is usually around 30 percent. Depending on variations in regional tax codes, it can go as low as 23 percent. That’s why Germany stays competitive with other OECD nations today.

In contrast, growing tax revenue from companies helping Germany’s economy with its boom after the crisis an overhaul is overdue. Taxation can be a competitive edge for a country and companies struggle with complicated regulations, especially around income tax.