The social security number in Germany is a unique identification number for the pension insurance. We’ve summarized all important information about the number in this guide.

Social Security in Germany

Germany has a well-developed social security system (Sozialversicherung). If you are obliged to pay social security in Germany, you are automatically a member of these five statutory insurance schemes:

- Health insurance (Krankenversicherung): pays the costs of visits to the doctor as well as for many medication treatments and therapies.

- Nursing care insurance (Pflegeversicherung): provides basic security in the event that you are permanently dependent on nursing care due to illness. Mostly, this concerns people in old age.

- Pension insurance (Rentenversicherung): pays employees a pension after they have retired. Roughly speaking, the amount of the pension is mainly based on income and the number of years you have worked and contributed into the pension insurance scheme in Germany.

- Accident insurance (Unfallversicherung): covers the costs of medical treatment and reintegration into working life after an accident at work or in the event of occupational diseases.

- Unemployment insurance (Arbeitslosenversicherung): provides unemployed people with an income for a certain period of time if they have been insured for at least one year in the last two years and are looking for work again. In addition, the Federal Employment Agency supports anyone looking for work by offering advice and placement services.

What is a social security number in Germany?

The social security number in Germany is your unique identification number for pension insurance. Along with the tax number and the tax identification number, one of the most important in your professional life.

While you use the tax number and the tax identification number (Steueridentifikationsnummer) mainly for your tax affairs in Germany, the social security number is important for your pension insurance.

Social security number equal to pension insurance number?

The pension insurance number is identical to the social security number in Germany and is entered in the social security card. According to SGB §147, this insurance number consists of 12 numbers and letters and always remains the same.

How do I receive my social security number in Germany?

In order to receive your social insurance number, you do not have to worry about applying with any German government agency. As soon as you enter the German workforce and start contributing into social security, you will automatically receive your social security number in Germany.

Your employer in Germany registers you with the pension insurance institution and you will then simply receive your social security card by post. You can also find your social security number on the pension insurance certificates.

It’s important to mention that in case your employer would like to have the social security number presented to you when you sign the contract, you can also apply for it yourself. As a rule, you contact your health insurance company, which will forward your application.

In case you happen to lose your social security card, you can have a new one issued without any problems. Get in touch with your health insurance company to issue a new social security card.

Your Social Security Card

In the past, you were given a pink social security card with your social security number printed on it. Since January 2011, German employees simply will receive the card as a letter. Like the tax identification number, the social security number is an individually assigned personal identification number. Everyone has a unique number with which they are identified within the statutory pension insurance.

Sample of the German Social Security Card

Even though your social security number in Germany never changes, you will receive a new social security card in case any of your personal information change. For example, if you change your last name after you are married, the registration office will inform the pension insurance company and they will send you a new ID card.

What information does the social security card contain?

That’s printed on your Social Insurance Card in Germany:

- your full name

- your birthday

- your social security number

What does the social insurance number look in Germany like?

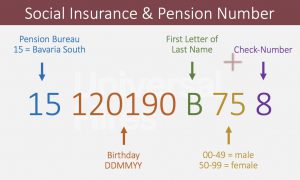

Explanation of the German Social Insurance & Pension Number

The pension/social insurance number is made up of a total of twelve numbers and figures. Each of these elements has a fixed attribution. It is made up as follows:

- 1-2: Area number of the pension insurance agency

- 3-8: Your date of birth

- 9: First letter of your birth name

- 10-11: Serial number (00-49 = male; 50-99 = female)

- 12: Check digit

What do I need the social security number in Germany for?

The social security number in Germaany is used to pay your pension contributions. You require the social insurance number for any work that is subject to social insurance contributions or if you apply for a social benefit such as unemployment benefit.

The social insurance card is also proof that you are legally employed and registered. In some sectors, such as construction, logistics or catering, you used to have to carry your social security card with you at all times.

The obligation to carry it with you and to present it was intended to combat illegal employment and illegal employment. Nowadays, however, an identity card or passport is sufficient.

Social Security in Germany for Foreigners / Expats

In practice, anyone who starts to work in Germany generally becomes subject to social insurance contributions. This also applies to employees from abroad. However, some special regulations must be considered.

Compulsory insurance for foreigners

Starting an employment in Germany requires the payment of social security contributions. If an employer hires an employee, he or she must check the employee’s insurance status.

The question of whether social insurance is compulsory or optional is of central importance. This determines whether benefit entitlements exist, whether contributions are due, and whether notifications must be made.

The German social insurance law does not apply to foreign employees who

- have been dispatched to Germany by their employer abroad,

- are employed or self-employed in several countries,

- are subject to an exceptional agreement with another state.

Registration and social security card for foreigners

Through notifications, the social insurance agencies receive data for processing the respective insurance. The employer registers every employee who is liable to pay health, nursing, pension and/or unemployment insurance with the appropriate health insurance fund. The employer registers part-time employees with the ‘Minijob’ head office.

To enable the social insurance agencies to correctly assign the insured person’s personal data, the correct pension insurance number must be entered. This number is on the employee’s social insurance card.

If an employee does not have a valid insurance number when registering, for example, because he or she has never worked in Germany before, the employer completes the following information when registering the employee:

- Name

- Name at birth, if it differs from the surname

- Place of birth

- Date of birt

- Gender

- Nationality

The collecting agency (health insurance fund) then informs the employer of the pension insurance number as soon as this has been assigned to the employee by the pension insurance fund.

If a non-German citizen of the European Economic Area (EEA) takes up employment in Germany for the first time, the country of birth and the insurance number assigned there must be stated, if known.

Family insurance for relatives of foreign employees

In Germany, spouses or registered partners and children can be insured free of charge through the member (§ 10 SGB V). The prerequisite for family insurance for foreigners is that the relatives have their residence or habitual abode in Germany.

In addition, they cannot:

- Have their own insurance,

- Receive an income exceeding 445 euros per month, or

- Have a ‘Minijob’ up to 450 Euro and

- Exercise a full-time self-employed activity.

Furthermore, spouses can only be insured as family members if they can prove a legally valid marriage with the member. Age limits apply to co-insured children.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.